Financial education has never been more important. Modern financial systems have grown at a rapid pace. People require specialised teaching even to begin to make sense of what is going on.

It can be quite challenging for those who have never studied these things in school. This is where Nexvolian comes in. We offer access to financial education to those who are interested in beginning their learning process.

Find instructions on how to register on Nexvolian below. We have made our website completely free to ensure as many people as possible sign up.

Signing up on Nexvolian is a breeze. Complete our straightforward registration form, conveniently placed on our homepage for easy access.

Nexvolian will connect the new user with a financial education company that suits their needs. This is done within seconds after registration.

A representative of the financial education company would get in touch with the new user to finish the registration process.

The representative will reach out using the contact info provided. We encourage users to take note of the details they fill in the form and avoid mistakes.

Discussing with the rep would go a long way in reconciling expectations between the new user and educator.

Financially literate people have tools that can help them make informed financial decisions. Aside from having the tools, they also will have the knowledge required to use them.

Managing expenses is easier said than done. However, with the necessary training, one can cultivate the discipline needed. Financial education gives people the knowledge to manage their expenses.

Having adequate information and the ability to understand it is very important. This can improve a person’s state of mind and give a semblance of security.

Investment education firms teach and tutor people in finance and investments. They have curated courses to achieve that end. Why have we at Nexvolian partnered with investment education firms?

At Nexvolian, we believe in the power of collaboration. That's why we've partnered with investment education firms. These firms share our vision and goals, and together, we're committed to providing users with personalized financial education.

The role learning investment psychology plays in the development of an investor is too essential to be understated. An investor's state of mind greatly influences their decision-making process. For the untrained, who have yet to understand their own psychology and why they do the things that they do, this can have a deleterious effect. Nexvolian partners teach investment psychology.

People educated by Nexvolian’s partners are equipped with the necessary skills. One of the most important skills to have is psychology. Investors must avoid succumbing to the lure of making financial decisions based on instincts. The ideal investor is a rational-thinking human who analyses every situation rationally.

People tend to talk about subjects they have some form of knowledge of. We see this in our everyday lives. This is also true for investments. How, one may ask? Getting the knowledge base required to enter the financial world may be good for an individual’s confidence.

What is Herd Mentality

This behavior can be found in financial investors. It is a phenomenon where, rather than making rational choices, people decide based on what others are doing. Market bubbles and crashes are symptoms of herd mentality.

Fear of Losing Out

The fear of losing out can cause people to make irrational market decisions, which is one trigger of herd mentality.

Overreaction and Underreaction

Overreaction occurs when the market reacts too strongly to new information. Conversely, underreaction occurs when the market doesn’t react strongly enough. Overreaction and underreaction are two sides of the same coin. Overreaction may lead to poor portfolio performance.

One needs to have an in-depth knowledge of psychology before testing the financial waters. Register on Nexvolian and learn from financial educators.

As humans, we all have our innate biases. It helps us compartmentalize things and make day-to-day decisions. However, biases can severely hamper our performance in the financial space. Knowledge is a powerful tool that allows us to recognise and control our biases. Learn more about the different kinds of biases at Nexvolian.

Bear and Bull markets are usually observed in the stock markets. Bull markets occur when there is general optimism in the market. High buying activity is recorded during this period. Everyone is happy as growth metrics rise and the price of stocks soar. This is a period of economic boom.

Bear markets are the opposite of bull markets. They’re characterized by a period of uncertainty as stock prices tank. Investors usually end up losing money in a bear market. People are more inclined to sell in a bull market.

It is essential to differentiate and recognise both types of markets. Nexvolian has partnered with investment education firms that teach everything about these markets.

Nexvolian has always been at the forefront of improving our users' experience. We believe in putting our users first in everything we do. This can be seen in how we operate our website and matching services.

There are many reasons why people choose us as a point of contact between themselves and investment education firms. Below, we talk about how Nexvolian caters to its users.

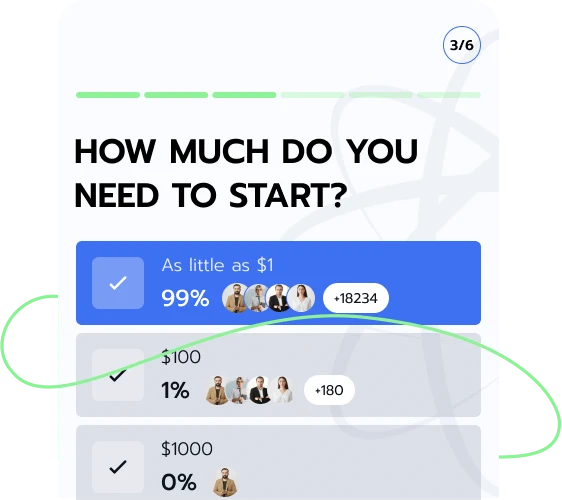

Nexvolian does not solicit money from its users. We believe financial education should be accessible to all and operate based on this belief. Using Nexvolian is free for all.

Everyone has different educational needs. Some people already have previous knowledge of finance, while others do not. We match people to the investment education firm that suits their needs.

The Nexvolian website is available in multiple languages. We aim to help people from different parts of the world connect to financial education firms, and to do this, we’ve had to break the language barrier.

Nexvolian has a user-friendly interface that makes it easy for people to navigate and find whatever they want.

Macroeconomically speaking, it is evident how important financial literacy and education are for the general public. Individuals with a basic understanding of finance are more likely to make informed financial decisions, so learning about the finance sector and investing from educators makes sense.

Nexvolian allows users to locate investment education companies without wasting time browsing countless websites.

Diversification is the practice of spreading out the value of a portfolio among different assets. Investors diversify to reduce risk.

A portfolio should be diversified, as this may help to quell losses caused by emotional biases. Sometimes, the investor needs checks and balances to weather market volatility.

Diversification can be used as a financial plan to focus on long-term goals. Learn the different ways in which one can practice diversification from Nexvolian’s partners.

Sometimes, financial markets behave differently than expected. These market anomalies directly contradict the Efficient Market Hypothesis, which postulates that the market follows set rules and is always rational. Being able to predict these anomalies may be an advantage. Learn more about market anomalies from suitable investment tutors.

The estate encompasses everything a person, family, or company owns. Managing an estate is a challenging task and usually requires certain skills.

The first thing to understand about taxes is that they vary widely. Different countries and even states within the same country have different taxing systems.

A good credit score can be beneficial. People with good credit scores may have better access to loans and financing.

When investing, it is essential to avoid pitfalls that may be criminal, like insider trading. Investors must endeavour to be ethical in their dealings.

Crafting a strategy is one of the most pertinent financial principles. What good is a ship on the vast ocean of finance without direction?

The difference between informed investing and bandwagoning is management and informed decisions. People must consider all the facts and carefully weigh their financial investments.

The world we live in today has become more complex. Technological advancements have yet to leave our financial systems untouched.

People need the requisite knowledge to understand and capitalize on these systems. The key takeaway is that people should register on Nexvolian and learn about finance.

| 🤖 Joining Cost | No fees for registration |

| 💰 Operational Fees | No costs whatsoever |

| 📋 Registration Simplicity | Registration is quick and uncomplicated |

| 📊 Focus of Education | Lessons on Cryptocurrencies, Forex Trading, and Investments |

| 🌎 Countries Covered | Excludes the USA, covers most other countries |